As a business owner, you are uniquely positioned to help your employees save for retirement. Their personal investment is good for their future—and the future of your business. To illustrate just how powerful early-career savings can be, we’re sharing the story of one employee, who started saving for retirement on a modest $35,000 salary in 1991 at age 25, and is on track to retire 10 years from now—in 2031.

Projecting forward based on a 100% investment in equities and the average return from 1991 to 2020 (10.7%), the employee will retire with a portfolio worth over $2 million dollars after a 40-year career.

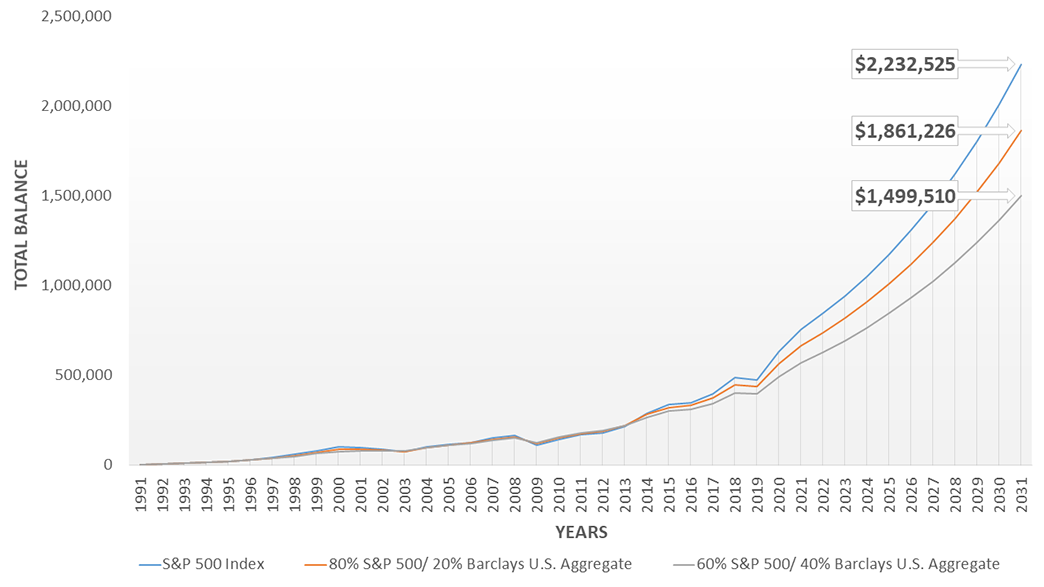

Based on this employee’s ongoing retirement contributions, we’ve outlined three 40-year investment strategies and included the resulting account performances in the chart below:

With this data, we can draw the following conclusions:

- If assets are invested in 100% equities, they would retire with $2.2M in the retirement account.

- If assets are invested in 80% equities and 20% fixed-income investments, they would retire with $1.8M in the account.

- If assets are invested in 60% equities and 40% fixed-income investments, they would retire with $1.5M in the account.

Even with the most conservative allocation, the employee was able to grow their wealth from modest monthly contributions to $1.5 million. Investing in 100% equities, however, would have generated an additional $700,000 (or 46%) in assets. Though the exact amount needed in retirement depends on one’s life expectancy and living expenses, this employee will be able to withdraw the equivalent of their annual salary during their last year of work in their retirement—thanks to early planning. They’ll not only be able to maintain their lifestyle, but also live off their savings over the long term.

The consistent account growth outlined above can be attributed to three key investment strategies that were adhered to over the course of the employee’s career.

1. Start saving as early as possible

Building a retirement portfolio is a long-term financial endeavor. By giving employees an incentive to start saving early in their careers, you help them build wealth over time by taking advantage of the power of compound interest and the time value of money. Simply put: the more time an employee’s wealth has to grow, the greater their chances of retiring comfortably.

Time is also a natural antidote to market volatility—and promotes accelerated growth as you approach retirement with compounding returns. For instance, between the ages of 25 and 35—a 10 year period—the account balance increased by $83,916. From the age of 60 to 65—the last five-year period before retirement—their account is projected to amass an additional $741,929, with assets more conservatively allocated in 80% equity and 20% fixed-income investments.

For workers in their 20s and 30s, retirement may seem impossibly far away. And for those with other financial responsibilities, including paying off student debt or starting families, they may struggle to start saving. But by offering employees financial assistance and promoting financial literacy in key concepts like retirement planning or the power of compounding interest, you can incentivize responsible, life-changing wealth-management behavior.

As the data shows, if retirement investments are prudently and strategically allocated, 30 years allows plenty of time for one to manage market volatility and harness the power of compounding interest.

2. Stick to the plan

When the market takes a dive, people tend to panic. But, historically, market downfalls are followed by upswings, and for investors seeking long-term growth, withstanding short-term market volatility is key. For instance, when the market crashed during the 2008 financial crisis, more than a third of the aforementioned employee’s retirement portfolio vanished in under a year. But those who stuck with their investment plan regained the entirety of their losses in a little less than two years—when the market bounced back.

Once an individual has committed to a plan, it’s important to follow through.

In general, experts suggest saving at least 10% of one’s income every year, with assets allocated between equity and fixed-income investments according to one’s risk tolerance and time horizon until retirement. The exact asset allocation will reflect each individual’s financial standing and goals.

3. Leverage the power of a 401(k) match

Employer matching contributions can help individuals reach that 10% savings benchmark—and in turn, they provide a simple way to enable responsible financial planning among your employees, promote a more productive workforce, and attract and retain talent. The robust financial support that a 401(k) provides can make a huge difference in savings over the course of a career. Not only do matching contributions help increase retirement savings, they also boost job satisfaction. A 3% match incentivized our example employee to save—and stay with their employer over the long term.

Employers benefit from implementing a retirement program as well. For example, employers who start a 401(k) matching program may be eligible for a tax credit worth as much as $5,000 to offset the costs of implementing the program and providing financial education for employees.

Your business is only as successful as the people that keep it running—so consider offering them the opportunity to save more for retirement. By giving each of your employees peace of mind as they start planning for their futures, you can help your entire operation thrive.