The routing number for Health and Benefits Accounts (HSA, FSA, HRA, QTA) is 067015928.

We offer multiple debit cards based on your account. Below are the purchase limits for each:

| Account Type | Purchase Limit |

|---|---|

| Consumer | $3,000 |

| Fresh Start | $200 |

| Business | $5,000 |

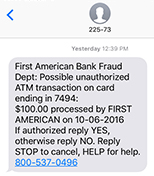

First American Bank Fraud Dept.: Possible unauthorized transaction on card ending in xxx: $xxx.xx processed by MERCHANT NAME on DATE. If authorized reply YES, otherwise reply NO. Reply STOP to cancel, HELP for help 800-537-0496.

If you receive an automated phone call, the recorded voice will identify as being on behalf of the First American Bank Fraud Prevention Department.

If you receive an email, it will be from DoNotReply@FirstAmBank.com.

- Log in to Online Banking and from the Accounts Summary screen click on 'Profile'.

- Click on 'My Contact Information'.

- Click on the Update button that corresponds with the Address section.

- You may select to change an In the U.S. address or an Outside U.S. address.

- Fill in required fields and then click Submit.

- Log in to Online Banking and from the Accounts Summary screen click on 'Profile'.

- Click on 'My Contact Information'.

- Click on the Update button that corresponds with the Phone Number section.

- Fill in required fields and then click Submit.

- Log in to Online Banking and from the Accounts Summary screen click on 'Profile'.

- Click on 'My Contact Information'.

- Click on the Update button that corresponds with the Email Address section.

- Enter and confirm your new email address, then click Submit.

- Elect to receive a text message, to receive a voice call, or to answer questions in order to verify your identity.

- Once the Identity Verification has been completed, your email address will have been updated.

From the 'Account Summary' sub navigation tab (under the 'Accounts' section, click on the 'Order Checks' link associated with the checking account in which you wish to order checks.

- From the 'Account Summary' sub-navigation tab (under the 'Accounts' section), click on the appropriate account to be directed to the 'Account Activity' page for that account.

- Locate the transaction on the 'Account Activity' page. You may search for the transaction by entering the check number or by narrowing down your search by date range, description, the amount of the transaction or transaction type.

- Once the transaction is located, click on the check icon appearing next to it.

Please note it can take 24-48 hours for a check to be viewable online after it has cleared and posted.

- From the 'Account Summary' sub-navigation tab (under the 'Accounts' section), click on the appropriate account to be directed to the 'Account Activity' page for that account.

- Locate the transaction on the 'Account Activity' page. You may search for the transaction by narrowing down your search by date range, description, the amount of the transaction or transaction type.

- Once the transaction is located, click on the deposit icon appearing next to it.

- Click the 'Deposit Item' link that displays below the image of the deposit slip.

The Available balance is the amount of funds available for immediate withdrawal or use. The available balance is your current balance less any pending transactions (e.g. withdrawals, deposits, etc.) that have been presented for payment but have not yet posted to your account.

To learn more about First American Bank's Rules and Regulations Governing Deposit Accounts, please click here.

- Select the Transfer Funds option.

- Click Deposit-Only Accounts. This feature gives you the ability to have 'transfer to' access to any First

- Fill out required information under Deposit-Only Account Manager. Click Continue.

We support the two most recent versions of the following browsers*:

PC/Windows Browsers:

- Internet Explorer

- Firefox

- Safari

- Google Chrome

- Firefox

- Safari

Mobile Banking allows you to perform everyday banking functions using a mobile device. For example, you can access your account balances and review your most recent account activity without being tied to a computer. Since you can have your mobile device with you all the time, you can receive Mobile Alerts at any time. Used in combination, Mobile Banking and Mobile Alerts can provide enhanced service and security.

Mobile Banking can be used in two different modes:

- Mobile Text/SMS Banking: Using Short Message Service (SMS), this service enables you to retrieve information about your bank accounts from a mobile device using text messaging.

- Mobile Web/Mobile App Banking: Using your mobile device’s data connection, this service provides you with a friendlier interface and a login with password feature.

- Log in to First American Bank’s desktop site using your Online Banking Login ID and Password.

- Select the ‘Profile’ icon at the top of the page.

- Select ‘Manage Biometric Authentication’.

- Select the delete icon associated with the lost or stolen device.

- Select the ‘Deposit’ menu option.

- Choose the eligible account where you want to deposit your check.

- Sign the back of your check and write “For Mobile Deposit at First American Bank” below your signature.

- Place your check on a dark-colored, plain surface that’s well lit.

- Position your camera directly over the check (not at an angle).

- Take a picture of the front and back of your endorsed check with your mobile device.

- Fit all 4 corners in the guides of your mobile device’s camera screen.

- Enter the check amount.

- Submit your deposit.

Android versions prior to releases of 2013 are not supported. This includes the following Android versions.

| Code Name | Version Number | Initial Release Date | API Level | Support Status |

|---|---|---|---|---|

| (No codename) | 1.0 | September 23, 2008 | 1 | Unsupported |

| (Internally known as "Petit Four") | 1.1 | February 9, 2009 | 2 | Unsupported |

| Cupcake | 1.5 | April 27, 2009 | 3 | Unsupported |

| Donut | 1.6 | September 15, 2009 | 4 | Unsupported |

| Eclair | 2.0-2.1 | October 26, 2009 | 5-7 | Unsupported |

| Froyo | 2.2-2.2.3 | May 20, 2010 | 8 | Unsupported |

| Gingerbread | 2.3-2.3.7 | December 6, 2010 | 9-10 | Unsupported |

| Honeycomb | 3.0-3.2.6 | February 22, 2011 | 11-13 | Unsupported |

| Ice Cream Sandwich | 4.0-4.0.4 | October 18, 2011 | 14-15 | Unsupported |

| Jelly Bean | 4.1-4.3.1 | July 9, 2012 | 16-18 | Unsupported |

b all, bal all: Retrieve all account balances (Note: the available balance for deposit accounts is the balance of funds available for withdrawal or transfer excluding any overdraft protection products you may have; certain pending transactions, such as deposits that contain checks, may not be immediately available and wouldn’t be included in the available balance.)

b [nickname] or bal [nickname]: Retrieve the available balance of the nicknamed account

t [from acct nickname 1] [to acct nickname 2] [amount]: Transfer funds between two accounts

h, hist: Last 5 most recent transactions

h [nickname] or hist [nickname]: Last 5 most recent transactions for the nicknamed account

More: Next 5 transactions

Nick: List of your account nicknames

HELP: List of available commands

STOP: Unsubscribe from mobile text banking

The following Alerts are automatically sent to your email address (including Transaction Verification). You can add additional email or SMS/Text notifications:

|

Customer Alert

|

Action

|

|---|---|

| Login ID Disabled | Notify me when my Online and Mobile Banking Login ID is disabled due to failed attempts to log in. |

| Login ID Enabled | Notify me when my Online and Mobile Banking Login ID has been enabled so I can regain access to my account. |

| Login ID Changed | Notify me when my Online and Mobile Banking Login ID has been changed. |

| Password Changed | Notify me when my Online and Mobile Banking Password has been changed. |

| Debit Card Ordered | Notify me when a new debit card has been ordered. |

| Contact Information Changed | Notify me when my contact information has changed. |

- Log into Online Banking

- Click on the 'Transfer Funds' tab at the top of the screen

- Click 'External Accounts'

- Click 'Add an account at another financial institution that is not listed above'

- On the next screen, input the information requested for the account

- Within a few days of submitting this information, two small deposits will be made to your external account

- To complete the setup of your external account, return to the 'Manage external accounts' page and verify the amount of the deposits. Once the External Account has been verified, you will be able to schedule transfers to and from the account.

After you enter your Eligible Transaction Account information, you can send or request money from your contacts. They will be notified by email or text message that you wish to send money or are requesting money from them. You and your contacts will never need to exchange financial account information.

HSAs provide triple-tax advantages: contributions, investment earnings, and qualified distributions all are exempt from federal income tax, FICA (Social Security and Medicare) tax and state income taxes (for most states).

Unused HSA dollars roll over from year-to-year, making HSAs a convenient and easy way to save and invest for future medical expenses. You own your HSA at all times and can take it with you when you change medical plans, change jobs or retire.

Funds in the account not needed for near-term expenses may be able to be invested, providing the opportunity for funds to grow. Refer to the Consumer Portal to find out your investment options.

To be eligible to set up an HSA and to make contributions, you must be covered by a qualified high-deductible health plan, or HDHP.

- To be eligible to contribute to an HSA, you must be covered by a qualified HDHP and have no other first dollar coverage (insurance that provides payment for the full loss up to the insured amount with no deductibles).

- You may use your HSA to help pay for medical expenses covered under a HDHP, as well as for other common qualified medical expenses.

- Unused HSA funds remain in your account for later, and may be able to be invested in a choice of investment options, providing the opportunity for funds to grow.

The insurance company pays covered medical expenses above your deductible, except for any coinsurance; you can pay coinsurance costs with tax-free money from your HSA. In addition, you can use your HSA tax-free dollars to pay for qualified medical expenses not covered by the HDHP, such as dental, vision and alternative medicines.

Contributions

Tax-free contributions to your HSA can be made in a variety of ways, including:

- Pre-tax payroll contributions, if available through your employer.

- Online transfers — transfer funds directly to your HSA from your linked personal savings or checking account

- Send a check to First American Bank Health Account Services for deposit into your HSA.

- Rolling over or making a transfer from an existing IRA (Individual Retirement Account) to an HSA, but only once in your lifetime.

Distributions from your HSA are used to pay for qualified medical expenses. This can be done by the following methods:

- Paying for purchases and medical services using your First American Bank Health Account Services prepaid Mastercard® debit card.

- Using online bill pay through your online Consumer Portal.

- Requesting self-reimbursement through the Consumer Portal when you have already paid out-of-pocket for qualified expenses.

- Paying with an HSA check (fees may apply).

Your HSA allows you to save pre-tax income that you can use to pay for qualified short- and long-term medical expenses. It complements your HDHP, giving you an additional method to save specifically for healthcare costs.

- HSA accountholders can choose to save up to $3,550 for an individual and $7,100 for a family (HSA holders 55 and older get to save an extra $1,000 - and these contributions are 100% tax deductible from gross income.

- Minimum annual deductibles are $1,400 for self-only coverage or $2,800 for family coverage.

Please refer to the Consumer Portal for a listing of investments available to you along with their return rate. Via Consumer Portal, you may choose which mutual funds you wish to purchase and sell. You may use Consumer Portal to review your investments as well as update the percentage allocated to each mutual fund you have chosen.

If you use your funds for qualified medical expenses, the distributions from your account remain tax-free. If you use the monies for non-qualified expenses, the distribution becomes taxable, but exempt from the 20 percent penalty. With enrollment in Medicare, you are no longer eligible to contribute to your HSA. If you reach age 65 or become disabled, you may still contribute to your HSA if you have not enrolled in Medicare.

- Healthcare FSA: Covers medical, prescription, dental and vision expenses

- Dependent Care FSA: Covers dependent care expenses including daycare, nursery school and day camp for children (up to the age of 13), and services for adult dependents who cannot care for themselves

- Limited Health Care FSA: Covers dental and vision expenses only (for compliance with a Health Savings Account)

Only those who have FSA coverage through December 31, 2020 can continue to incur claims against the 2020 plan year for services provided through March 15, 2021.

All FSA claims for services provided January 1, 2020 through March 15, 2021 will automatically be applied and processed from the 2020 plan year first if filed by the claims filing deadline for that plan year. If your claim exceeds the available funds from the 2020 plan year, any excess will be automatically applied to the 2021 plan year.

For FSAs with Rollover, on October 31, 2013, the U.S. Department of Treasury changed the policy on remaining funds in FSA’s. You are now able to roll over remaining funds into your next plan year up to $500.00. This rollover means enrollment in an FSA is much less risky. This gives you more flexibility to spend your FSA money when you need it. You can use it for necessary out-of-pocket healthcare expenses, rather than feeling pressured to engage in last minute and potentially unnecessary spending at the end of the year.

- The amount you put into your FSA

- The tax percentage you would normally pay on that money (tax bracket)

Let's say you normally pay 30 percent in federal, social security and state taxes on your income. In this example, you would enjoy a tax savings of 30% of the $2,000. In other words, you could get a $600 tax savings on the $2,000 you directed to your FSA.

- Parking: Expenses for parking at or near your work location or at or near a location from which you commute using mass transit.

- Transit: Expenses include public transportation such as train, bus, monorail, streetcar, subway, ferry. This also includes services such as UberPool and Lyft Shared. Vanpool expenses are eligible, but the highway vehicle must seat at least six adults, excluding the driver.

If available for your region, you can also place a Smart Commute order to load your transit authority smart card from the Consumer Portal. See the Smart Commute section for more information. When you use the prepaid debit card or Smart Commute, you don’t need to submit receipts to substantiate your expenses.

For parking and vanpool expenses, you can pay out-of-pocket and request reimbursement for your expenses on the Consumer Portal or mobile app. Reimbursement can be issued via direct deposit to your bank account or check. Mass transit expenses are not eligible for reimbursement per the IRS, when an eligible method such as the benefit debit card or Smart Commute are available.

- Loan Submission Form (with all of the sections completed, all of the questions addressed, and signed and dated by the originator)

- 1003 (with the terms of the second mortgage)

- 1008

- Flood hazard determination

- Income verification

- Signed Applicant’s Authorization

However, if you are still working, you are not required to begin RMDs from your employer sponsored plan until April 1 of the year following the year in which you terminate employment. This exception does not apply if you own more than 5% of the employer, nor does it apply to IRAs.

Special Note: For 2020 the CARES Act temporarily suspended the RMD requirements from IRAs and qualified retirement plans provided the employer sponsoring the plan adopts the CARES Act provisions. Check with the sponsor of your retirement plan to confirm if you must take an RMD for 2020.

a. $19,500 for 2021;

b. the maximum deferral amount allowed under the terms of the plan; or

c. the amount that allows the plan to meet the required nondiscrimination tests.

In addition, if you attain age 50 or older by December 31, you may defer an additional $6,500 catch up contribution.