Managing risk through investment portfolio diversification is frequently one of the most obvious wealth management strategies that business owners and investors overlook—especially in today’s volatile economic climate.

Most experienced investors understand that allocating investments across a range of asset classes, sectors, and varying risk profiles is key to wealth generation. Yet, business owners who have amassed the majority of their wealth through the growth of a closely held company often ignore this rule.

Investing back into one’s own company, employees, and community fuels the foundation of America’s business entrepreneurship culture and is, of course, of vital importance for business success. A common mistake we see, however, is business owners who put themselves uniquely at risk when it comes to wealth preservation and growth by being too heavily invested in their single most important asset—their own business.

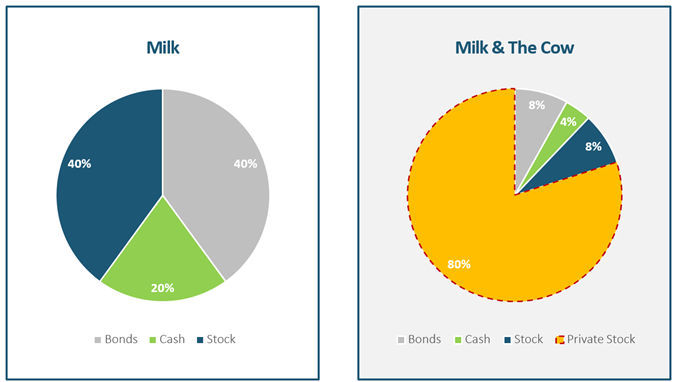

For example, let’s consider a dairy farmer’s view of wealth. They, like most business owners, may consider their business to be only a portion of their entire investment portfolio. The result is something like the “Milk” chart illustration below. Here, we can see what this business owner would imagine their investment portfolio to look like, with the milk being their portfolio of cash or what they’ve invested in the stock market.

The chart below, however, gives us a more accurate depiction of this dairy farmer’s portfolio. In this chart, we can see that the majority (80%!) of this business owner’s investment is actually tied up in their own company, illustrated here as “The Cow.”

There is a big difference in the charts above. The key takeaway is for the business owner to recognize the importance of looking at their assets and investments accurately in order to gauge if they will reach their long-term goals and decide whether or not they’re diversified properly.

So, what should business owners understand before beginning to diversify their portfolio?

The first key to portfolio diversification is creating ample liquidity. This will be subjective for each person as “ample” refers to how much liquidity will be needed to accomplish specific investment goals. It’s also essential for business owners to understand the strategies available to get to liquidity in the first place. For example, a short-term investor may invest in bonds as a way to create ample liquidity, while a long-term investor would be better off investing in equities.

This is where it becomes invaluable to have a senior financial advisor who understands your goals and needs and has the specialized experience to get you where you want to be.