For many business owners, managing daily operations and growth are difficult enough. As a result, planning for a well-structured business succession strategy is not typically prioritized. What business owners do not realize is the tremendous risk procured by not having a properly structured succession plan.

Lack of planning has outsized financial and economic consequences for business owners and their businesses. 70% of America's 12 million privately owned businesses, where Baby Boomer wealth is concentrated, are expected to change hands in the next 10-15 years. Yet, 75% of business owners admit that they have not made a plan to transition the ownership and management of their companies when they are ready to step down.

A well-structured succession plan is the foundation for preparing for a company’s future success, the financial wellbeing of its owners and employees, and the continuation of its founders’ visions. It also establishes the framework for a company’s continued growth and identifies future leadership, which are particularly important for business owners who intend to hold on to a portion of their personal equity after they leave.

There are a multitude of exit strategies that exist for small and mid-sized business owners when it comes time for them to move on to the next stage in their life. Most commonly, these include selling to a strategic buyer or private equity, an initial public offering (IPO), a leveraged recapitalization, or a management buyout.

The right strategy for each business or entrepreneur depends on a complex matrix of variables and decisions. Among the most essential for business owners to consider when beginning to plan an exit strategy are the ownership dynamics. For example, is the company a family business? What is the current corporate structure of the company? Business owners also need to consider liquidity objectives versus continued equity in the business, current taxation, legislation, and government regulations, the competitive landscape and valuation at the time of sale, and the company’s overall objectives for succession when it comes to existing management and employees.

One approach First American Bank finds invaluable is employee stock ownership plans (ESOPs). These are an often overlooked and misunderstood business liquidity and succession strategy for small and mid-sized business owners that offer significant taxation and governance benefits.

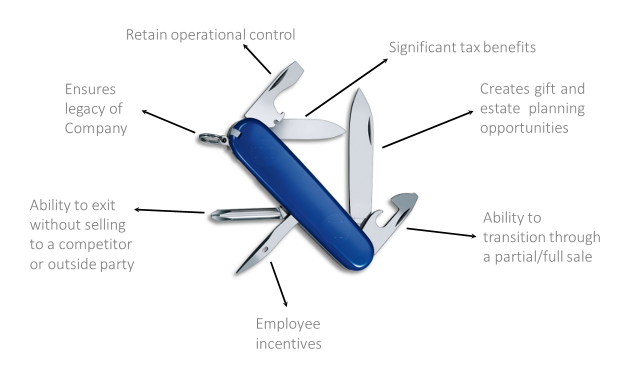

Originally conceived in 1950, ESOPs are an extremely effective way to transition the ownership of your business while maintaining the company culture that’s been built. Simultaneously, ESOPs provide benefits to each participant in the transaction, making them a powerful financial planning tool for the accumulation and generational transfer of wealth. Perhaps one of their most unique characteristics is their flexibility, outlined in the below graphic.

For the business owner, ESOPs allow for the deferral of capital gains taxes on the sale of their company if at least 30% of the business is sold, with the potential for these deferrals to be permanent. From a governance standpoint, ESOPs also allow for owners to retain effective control of their businesses while they transition the day-to-day operations to the next generation of leadership over time along with the opportunity for participation in long-term equity growth.

For employees, ESOPs amount to a qualified, defined contribution benefit plan that results in the accumulation of shares in the company annually without cash contributions. This builds employee wealth over time and encourages talent retention as the company grows through valuation gains.

From a company perspective, the tax benefits can be substantial as well for both C-Corporations and S-Corporations. This includes the ability for a 100% ESOP-owned S-Corporation to retain the company’s entire federal and state income tax obligation in the ESOP, substantially enhancing the growth opportunities for its members.

The result for entrepreneurs, their employees, and companies alike is a win-win transition of leadership. With so many effective options on hand, business owners should make their succession planning a priority to ensure the continuation of their growth and legacy.